Month: March 2022

With prices of everything going up, here's your reminder to start your small home-based business. Doesn't matter if you sell a couple things a month on Ebay or Etsy or Facebook Marketplace, do odd jobs in your neighborhood, whatever. As long as you can show you are trying to run a small business. Then you can write off mileage and a percentage of your home expenses (Maine is up to 30%). I'm pretty sure you don't even have to turn a profit for the first couple years. You don't even need to incorporate or have an EIN number. Your business info can be claimed on a Schedule C on your taxes. The government took away home office deductions, so this is a way to get them back. I'm not an accountant or a lawyer, and this isn't professional advice. It's just what I do. Check the laws in your area…

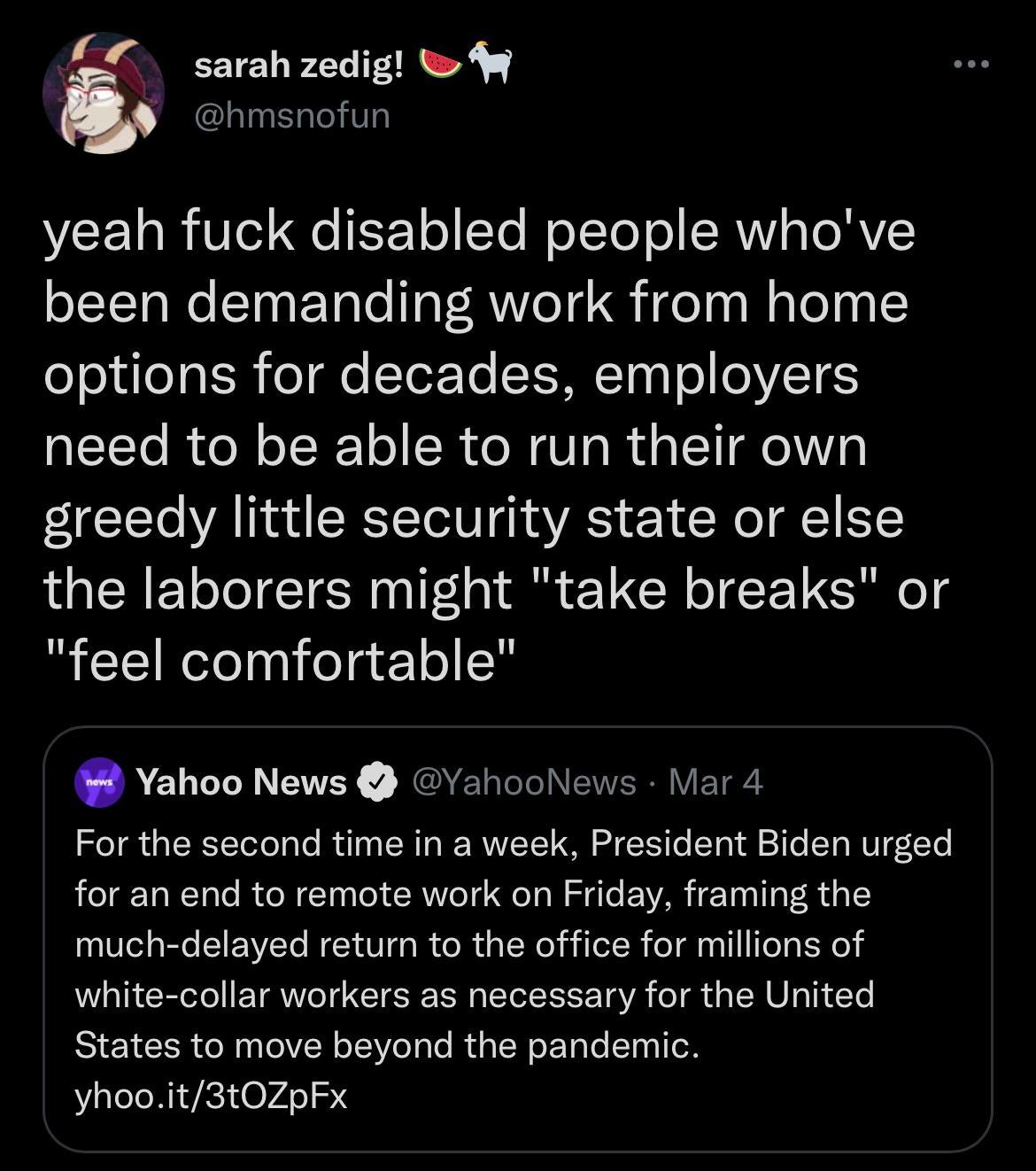

Capitalism at it’s best.

Employee or self-employed?

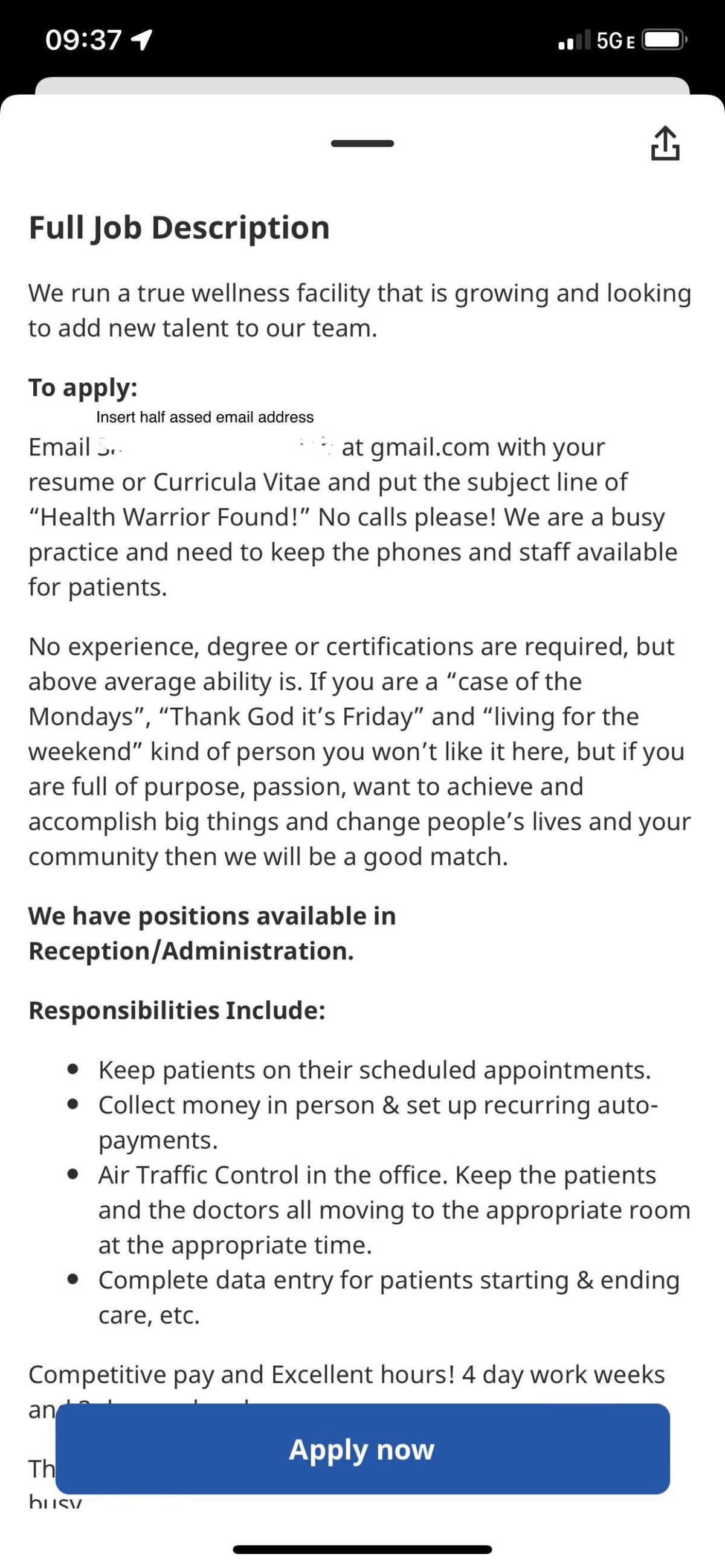

This is in California. Other details changed for anonymity. My friend “Gary” got a job last year working at an office doing logistics. His offer letter stated his title, his salary of $20/hr, “health benefits” (verbatim), no PTO, and a start date. All of last year he got paid with a company business check (the type they use to purchase business items or pay bills on behalf of the company). He didn’t get a wage statement, no taxes taken and the health benefits he was offered were never given. When he brought it up to his employer, they stated it was coming soon, but it never came. This year he gets a 1099 instead of a W-2. His job entails doing the core responsibilities for the company. Including logistics, inventory, and customer service. Gary is upset because he feels he was swindled into being classified as a contractor instead of…