Someone in another thread was going on with the usual tripe about how things aren't great now, but it's not like our parents didn't have it hard, too! Since I see this nonsense a lot, I wrote a more detailed reply than usual. In short, mom n pop sure as fuck DID HAVE IT MUCH EASIER.

--- --- --- --- --- --- --- --- --- --- --- ---

In 1981 average household income was around $23,000. Inflation adjusted that gives us about $74,000 in current USD (1).

In 1981 the average price of a house almost precisely three times earnings, coming in at $69,000. That adjusts up to $223,000.

The average home cost has shot up to $428,700 – almost double what we'd expect and about 5.5x avg earnings.

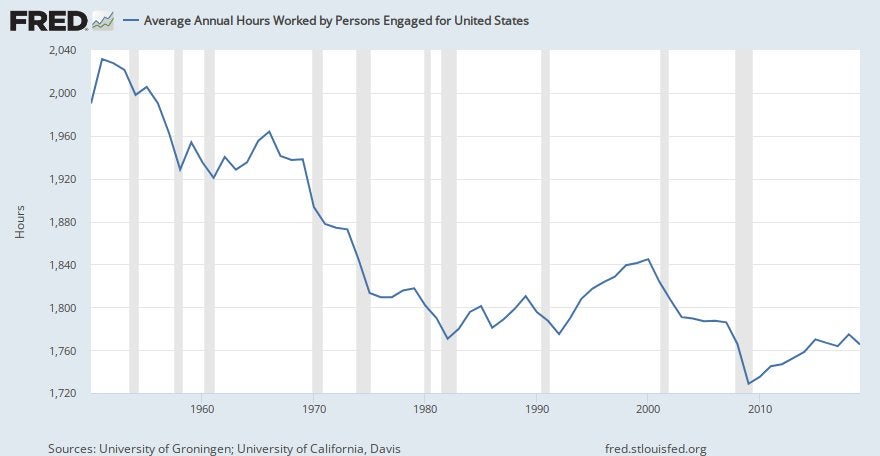

Current average household income is $78,000, which has the appearance of gaining $9k over expectation. That breaks down when we consider that worker productivity has tripled, and households are now twice as likely to be dual-earner(3). Maybe we can get a better comparison.

The St. Louis Fed shows that average real hourly income (continuous chained 2015 dollars) in mid '81 was about $9, compared to $5.25 now (2). The 1.71 ratio provides another way to compare purchasing power. The adjusted housing price has a .52 ratio. Dividing the earning ratio by the housing ratio gives us 3.3.

That is the multiplier; this is too say that if all other things were equal, an average buyer today would have to work 3.3 times as long to buy the average house.

There are other problems, though. Entry level pay has been dismembered even as rent prices (indexed to the early '80s) has quadrupled (4.18x). That down payment won't take 3x as long to save up – it might take 12x as long (4).

So if Mom & Dad took 3 years to save, a youngster today can look forward to saving muuuch “harder” to get it done before they are 50. No new cars, no vacations. And when we add in student loan debt…

Lastly, the parents might've bought in at peak interest, but if they refi'd a decade later, they fully cut their mortgage in half. That is not in the offing for current buyers.

Lastly, let's not forget that those hefty mortgage interest rates were being subsidized by Uncle Sam anyway, via the mortgage interest deduction.

Grim stuff overall.

Source 1: BLS.

Source 2.

Source 3

Source 4

Edit: fun bonus