By becoming aware of your exploitation you have begun to understand yourselves which is good. However, to beat an enemy you also need to understand him first and that he has many ways to mess with you, some less obvious than others. Inflation is one of these ways, as it is to some extent a tax for the poor.

So time to get financially literate. You may think it is “corporate greed” that is the cause of inflation (and yes, it surely plays a role to speed it up at the moment), some may see also other reasons (there are many reasons that have an effect on it). However what is the “root cause” that set things in motion some time ago (as things do happen for reasons)? I am here to cast a light on this issue, as it is often forgotten because humans are bad at capturing long term effects that only really become apparent after some delay.

Some excerpts:

“Inside the closed-door FOMC meetings, quantitative easing was debated during 2010 for being what it was — a large-scale experiment that carried unclear benefits and risks. There was more opposition to the plan than was publicly known at the time. Hoenig wasn’t the only FOMC member with strong objections to the plan. The regional bank presidents Charles Plosser, Richard Fisher and Jeffrey Lacker expressed concerns about it, as did a Fed governor named Kevin Warsh.

The Fed’s own research on quantitative easing was surprisingly discouraging. If the Fed pumped $600 billion into the banking system in roughly eight months, it was expected to cut the unemployment rate by just .03 percent. While that wasn’t much, it was something. The plan could create 750,000 new jobs by the end of 2012, a small change to the unemployment rate but a big deal to those 750,000 people.

There were many downsides to the plan, but the risks all played out over the long term. The primary worries were the ones Hoenig pointed out, about risky lending and asset bubbles. But there was also concern that quantitative easing could create price inflation, encourage more government borrowing (because the plan worked by purchasing government debt) and that it would be very difficult to end once it began because markets would become addicted to the flow of new money.

[…]

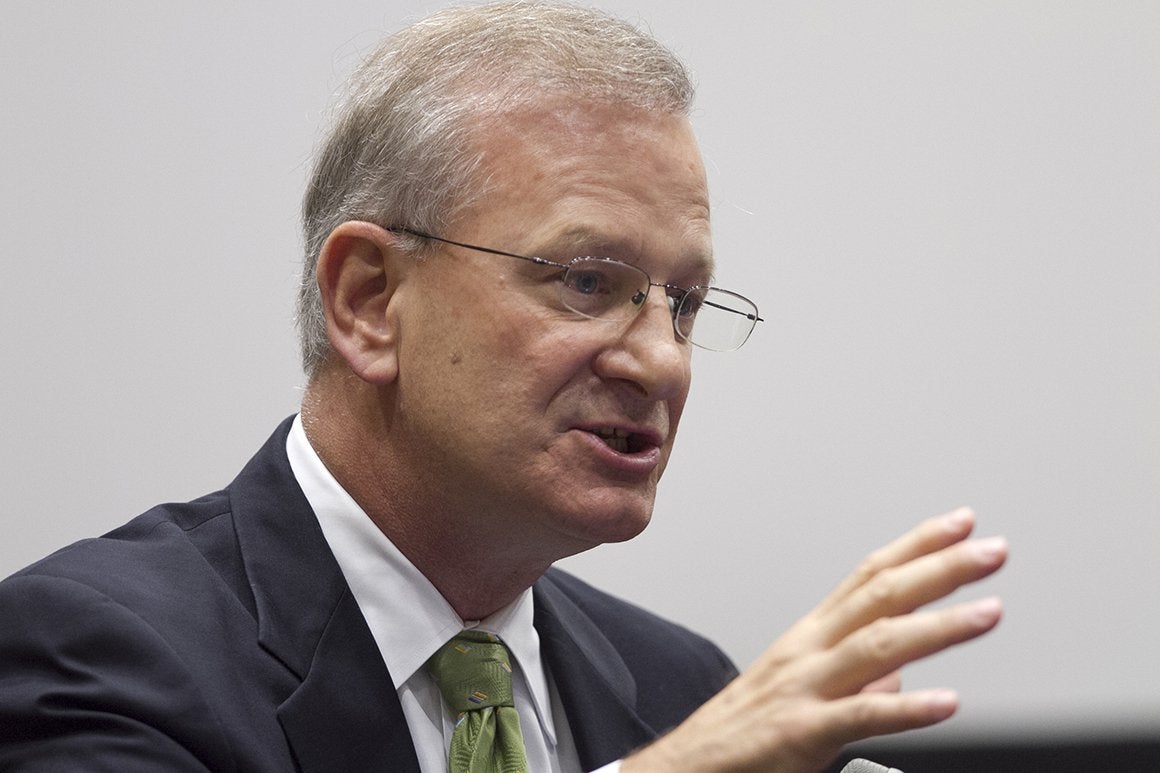

Fisher, the Dallas Fed president, said he was “deeply concerned” about the plan. “I see considerable risk in conducting policy with the consequence of transferring income from the poor, those most dependent on fixed income, and the saver, to the rich,” he said at the time.

[…]

For Hoenig, the most dispiriting part seems to be that zero-percent rates and quantitative easing have had exactly the kind of “allocative effects” that he warned about. Quantitative easing stoked asset prices, which primarily benefited the very rich. By making money so cheap and available, it also encouraged riskier lending and financial engineering tactics like debt-fueled stock buybacks and mergers, which did virtually nothing to improve the lot of millions of people who earned a living through their paychecks.”

If this angers you the best thing to do is to learn more about these processes. You need to understand what the “big guys” are doing and how it affects you. Otherwise you can hardly see if a financial policy is good or bad for you if changes are proposed. Rules in this sector are obscure for a purpose, that the normal worker does not understand how owners fuck them with these rules. And yes, owners here obviously include all these large stock holders, insider traders and officials at the FED and similar institutions.