Category: Antiwork

Response of the year

Bonus and profit share taxing

So I get bonuses and profit share from my job. And by my understanding bonus and profit share gets taxed different (heavier). But it’s the federal tax withholding that is taxed higher. Googled it but I’m having trouble figuring out if I’m making less off bonuses or not. So am I actually loosing money or do I just get more back on my income tax? Please help me understand if I’m actually making less or not. I’m not a tax expert. Just trying to figure out how it all works. I work for a very bonus driven company. It’s nice but not guaranteed pay. I’ve also been told the “you make X amount more an hour due to bonuses.” I’m in the US.

Remote Work Employer Relocation Issue

I have been successfully working remotely for a CT employer for a year and a half from MA. I travel throughout the country about 25% of the time for this role and have only gone into the CT office a total of six times. My partner lost his job last year and has now found new employment in KS. His job is on-site and so we must relocate. My employer allows remote work in 17 states, which does not include KS. We are equal earners so it seems it is best for him to take the KS job and us to relocate to a lower cost of living area. I am extremely frustrated to have to choose between my family and my career, especially as a woman, when I have received nothing but praise regarding my work performance. My employer allows remote employment in high burden states such as CA…

The office is open style with everyone having their own cubicle office space. The newly installed cameras are 360 cameras but directly face our “offices”. No we were not asked about this nor did we sign anything. 🤨

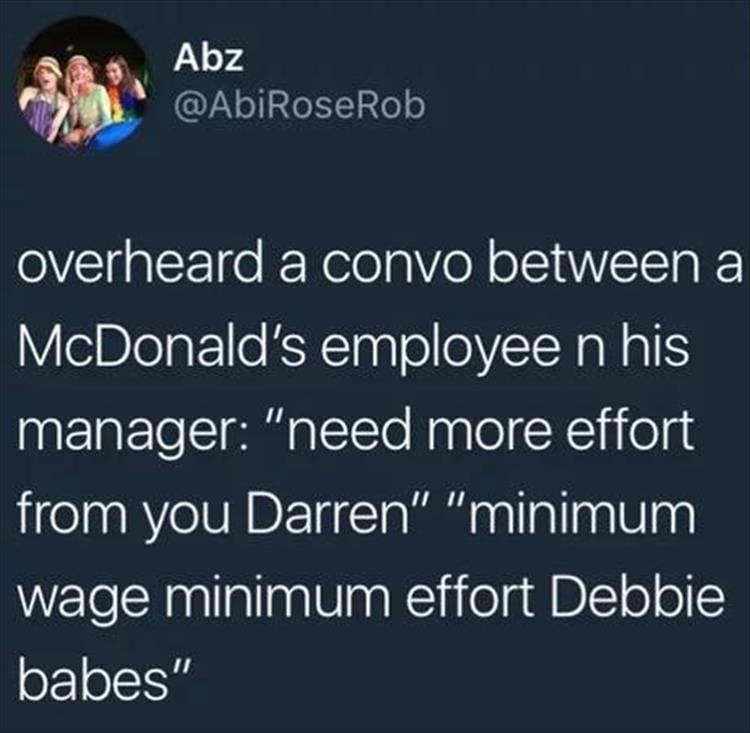

The tipping culture in America is getting out of hand and, quite frankly, ridiculous. I know this is highly unlikely, but what if we just refused to tip. Ever. Wonder how long it would take before the workers demanded change in their salaries?

I don't want to give many specifics but I'm not getting the accommodations my doctor made. They said my accommodations are on the “works”. Either say you can't accommodate me so I can go on temp disability or actually do what the doctor says.

I think it’s ridiculous it’s not a requirement for breaks to be paid out. I’m not clocking out if im still at work! That 30 minute I took on my lunch isn’t more time im able to spend, taking care of the house, paying bills, mowing the lawn, going to the bank, going shopping, or running any errands. If there is a 30 minute period at work that I’m not being paid then I should be able to leave 30 minutes early, but that’s not the case. No one gets compensated for the 30 minute to an hour drive to work or the drive back so the least they can do is pay us for our breaks.